We Are The Multifamily Experts

I am a seasoned veteran in Commercial Real Estate. I started my career 30 years ago working for some of the largest private owners and was actually on the pre-capitalization team for Home Properties of NY. We stabilized approximately half of their assets before the IPO they were so amazed they requested one of my new hires to be their first marketing director. Owners and companies over the years have brought me and my teams in to fix the unfixable problems. Usually after companies had tried all their solutions to the fix the problem they would call my company as a last shot. Remarkably we have been very successful so much so that most of the companies early on wanted me to run their multifamily division. Our teams have stabilized and made profitable over $1 billion in multifamily assets over the last 25 years now we are taking that experience to a whole new level.

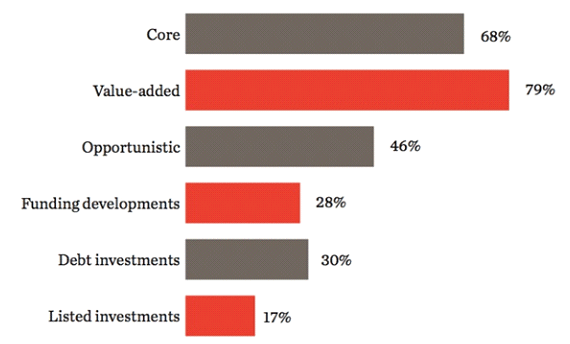

The most attractive real estate strategies today.

Where we are in the market cycle most true value adds are no longer available. There are still incredible investments to be had, but they are heavier lifts and while the returns are attractive it tends to be more risky. This also applies to what is now called Opportunity Zones. How can we minimize risk? Couple of thoughts: First and foremost you must have enough capital to address unforeseen challenges. Even with an experienced team you will most likely encounter land mines along the way which most likely will need more capital.

Secondly and just as important have people on your team that have a solid consistent track record of turning around these types of assets. I am planning on writing an article about an actual investment I was involved in that explains the importance of this. I have had the opportunity to oversee directly and indirectly the stabilization of over $1billion in distressed assets. I can not express enough the importance of having the right team when investing in opportunistic investments. Invest wisely.